Protect Your Legacy: Expert Lawyers for Wills and Trusts

The Importance of Experienced Legal Professionals in Estate Planning in New York Developing a thorough estate plan is vital to safeguarding your assets, supporting your loved ones, and ensuring your wishes are respected. In New York, effectively utilizing wills and trusts necessitates the expertise of knowledgeable legal practitioners. “Attorneys specializing in wills and trusts” can […]

Morgan Legal Group: Protecting Legacies, One Family at a Time

Honoring the Legacy of Hard Work and Protecting Your Family’s Future: The Morgan Legal Group Story At Morgan Legal Group, we understand that estate planning is more than just legal documents and financial strategies. It’s about protecting your legacy, honoring your values, and securing your family’s future. Our firm’s foundation is built on principles instilled […]

Unlocking Success: The Thrilling Journey Ahead

Russel Morgan: A Story of Resilience and Success At Morgan Legal Group P.C., we take pride in the journey that led to our establishment and the services we provide to clients like you. Starting from humble beginnings and striving for success is truly remarkable. This article delves into the importance of proper planning and how […]

Probate litigation

Navigating Probate Litigation in New York: Expert Guidance from Morgan Legal Group Dealing with the loss of a loved one is challenging enough without the added stress of handling their estate. Morgan Legal Group, based in New York City, offers expert probate services to help you navigate the legal complexities involved in the administration of […]

Will and Trusts

All About Wills and Trusts: Understanding Your Options for Estate Planning in New York Welcome to Morgan Legal Group P.C., your trusted partner for expert guidance on estate planning, Wills, and Trusts in New York. Making sure all details are accounted for. These are great next steps. In this comprehensive guide, we’ll explore the key […]

Estate Planning and Probate Attorney in Brooklyn

Seeking an Estate Planning and Probate Attorney in Brooklyn, New York: Expert Guidance for Securing Your Family’s Future Welcome to Morgan Legal Group P.C., your trusted source for estate planning and probate guidance in Brooklyn, New York. Our dedicated team understands the significance of protecting your assets and ensuring a seamless transition of your estate […]

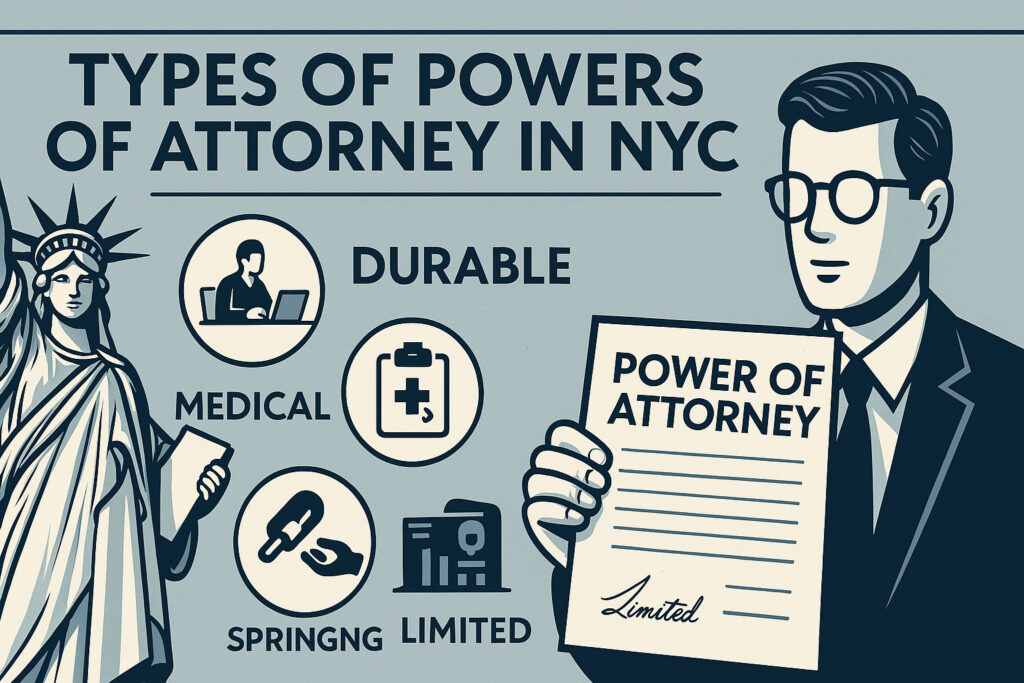

NYC Power of Attorney

NYC Power of Attorney: A Complete Guide to Protecting Your Future In the bustling city of New York, planning for the unexpected is crucial. A Power of Attorney (POA) is a legal document that allows you to appoint someone you trust to act on your behalf in financial and/or medical matters if you become unable […]

Estate Litigation Law

Expert Estate Litigation in New York with Morgan Legal Group: Protecting Your Inheritance and Resolving Family Disputes Estate litigation involves numerous challenges, particularly when you’re coping with the loss of a loved one while navigating legal disputes over their estate. The world of law can be extremely complicated if you have not had experience in […]

Probate

All About Probate in New York: A Comprehensive Guide Welcome to Morgan Legal Group P.C., your trusted source of information and guidance on the intricate process of probate in the state of New York. Understanding this process is essential. In this comprehensive guide, we will delve into every aspect of probate, shedding light on its […]

Will Lawyer NYC

Will Lawyer NYC in 2025: Your Guide to Secure Estate Planning Planning for the future is a responsibility we all share. In New York City, navigating the complexities of estate planning, particularly when drafting or updating a will, requires the expertise of a skilled “will lawyer NYC.” As we look toward 2025, understanding the evolving […]